What Is Debt Forgiveness In Canada?

When consumer debt becomes overwhelming and you find yourself struggling to make minimum payments, missing due dates, or avoiding calls from collection agencies, the stress

When consumer debt becomes overwhelming and you find yourself struggling to make minimum payments, missing due dates, or avoiding calls from collection agencies, the stress

Choosing between a variable vs fixed mortgage represents one of the most significant financial decisions Canadian homeowners face. This choice can impact your finances for

When you’re planning to sell your current home and purchase a new one, you might be worried about the financial implications of breaking your existing

Making the decision to cancel a credit card is more complex than simply cutting up the plastic and tossing it in the trash. Whether you’re

Car ownership is a necessity for many Canadians. When the cost of that car becomes overwhelming, the vehicle repair loan attached to it can quickly

Debt can accumulate slowly or suddenly, through unexpected job loss, rising interest rates, medical emergencies, high living costs, or simply long-term reliance on credit. For

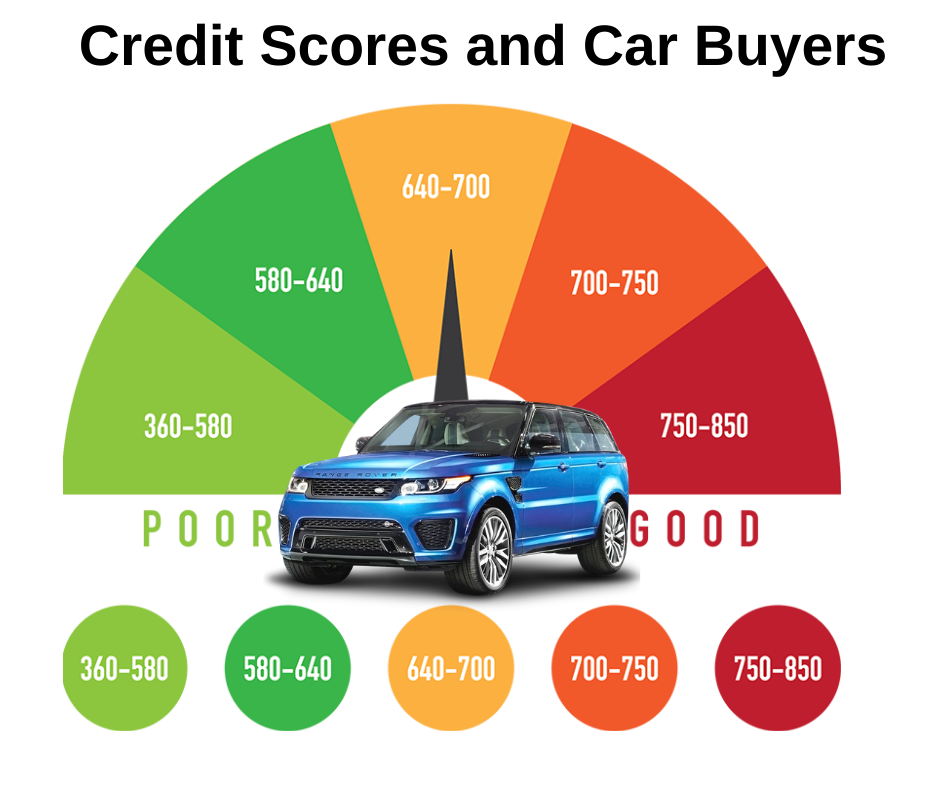

Buying a car in Canada almost always involves financing, whether it’s your first car or an upgrade to something more reliable. The moment you begin

Buying a home is one of the most meaningful financial milestones for Canadians, but when your credit score isn’t ideal, the process can feel intimidating.

Buying a home in Canada is a major financial milestone. For many people, it represents stability, security, and long-term investment. Yet the journey to homeownership

Buying a home in Canada is a process that requires careful preparation, clear expectations, and a deep understanding of the mortgage documents you’ll need along

When you’re living in Alberta and dealing with bad credit, finding financial help can feel like trying to clear a trail after a snowstorm. You’re

Payday loans in British Columbia are among the most talked-about short-term borrowing options available to Canadians who need quick access to funds. When an unexpected

Our 60 second application will allow you to connect to all our lenders in our network!

We have over 30+ lenders in our network. With a large selection you will be able to see more offers!

Our lenders have the fastest turnaround time in the business.

Sign up here to get your weekly tips on how to build credit!

Loanspot.ca can introduce you to a number of finance providers based on your credit rating. Loanspot.ca services all of Canada.

Our lenders specialize in loans, automotive, mortgages, credit cards, credit reports, insurance and much more!

Located in Calgary, Alberta, Canada 🍁